We understand that changes to your financial circumstances can be cause for concern, and these money worries can quickly turn into debt.

Whether these changes are due to a reduction in income, a relationship breakdown, the loss of your job, or you’ve suffered an injury or illness, it’s important to know that we’re here to help, so please don't suffer in silence.

This page provides information about managing your debts, making the most of your money and getting support with your finances.

I’m in debt – what can I do?

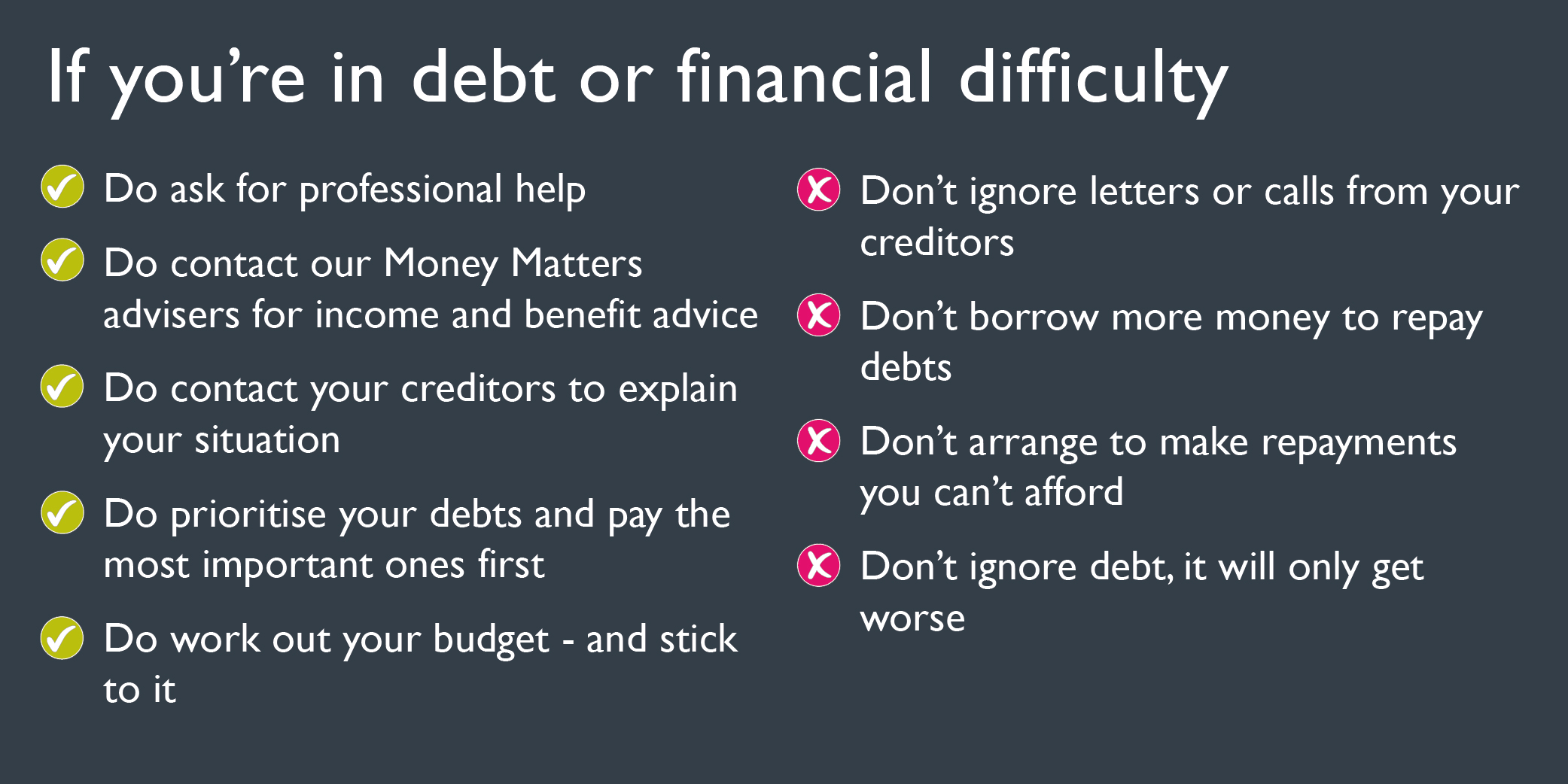

If you’re having financial difficulties, it’s essential to address the situation as early as possible. You can do this by:

If you’ve been refused a bank account, or you can’t get credit, then a credit union may be able to help. Credit unions provide savings and loans and are a much better alternative to illegal money lenders, doorstep lending companies or payday loans.

You can find out more and contact your local credit union here.

Below is a list of other websites that offer free debt advice:

Are you missing out on financial help? Click here to use the benefits calculator to work out your possible entitlements.

Avoid loan sharks

Loan sharks are illegal money lenders who are not licenced by the Office of Fair Trading. They usually come across as friendly at first but charge very high-interest rates that people can’t keep up with.

You’re under no obligation to repay illegal lenders, and you should report them. If you know about a loan shark, talk to the National Illegal Money Lending Team.

There are some small changes that you can make to help cut your spending and save money.

| Outgoings | How you could save |

| Rent or service charges |

Check whether you’re entitled to help with housing costs.

Click here to access an online benefits calculator or contact our Money Matters Team at moneymatters@saxonweald.com.

|

| Council Tax |

Check if you are entitled to council tax benefit or a discount (or both) by clicking here.

You can also ask if you can pay weekly, or monthly over 12 months rather than 10.

|

| Water charges |

Contact your provider to check what help and discounts you may be entitled to. To help spread the cost, you can ask to pay each week or month, rather than every 6 months.

|

| Gas or electricity |

Use one of the online energy checkers to see whether you can switch to a cheaper supplier. Or, talk to your provider they may be able to transfer you to a cheaper tariff or be able to offer a different payment method, such as budget schemes, a pre-payment meter or a monthly bill.

|

| Childcare |

Childcare includes nurseries, childminders and after school clubs. Check if you are eligible for any discounts, such as tax-free childcare, at www.gov.uk.

|

| Housekeeping |

The monthly amount you spend on food and drink and household items may fluctuate, so try not to underestimate this cost. Make savings on your food shop by planning meals, buying items on special offer (but only if you need them), choosing your own brands and remembering to use discount coupons.

Check if your children are eligible for free school meals. Some creditors will ask you to justify items such as cigarettes.

|

| Clothing |

Check with your local authority to see if you’re eligible for help in paying for school uniforms.

|

| TV licence |

You can pay your licence yearly or monthly. Check which suits your circumstances best. Visit www.tvlicensing.co.uk.

|

| TV and online subscriptions |

If you’re paying for satellite or cable TV or any online subscriptions, check how best to spread the cost, reduce your package or consider cancelling these subscriptions.

|

We are here to help

Our Money Matters Team offer a range of ways to help you access support and manage your money. You can email them at moneymatters@saxonweald.com.

Click here to find a list of other charities and agencies that can offer specialist help and advice.