Find a range of useful information about your tenancy and the services we provide in our tenants' guide.

No one deserves to be a victim of domestic abuse. Discover the support available to you here.

We offer a selection of garages to rent across the Horsham district. Find out more.

To request more information about tendering opportunities, or for any general procurement queries, please click here.

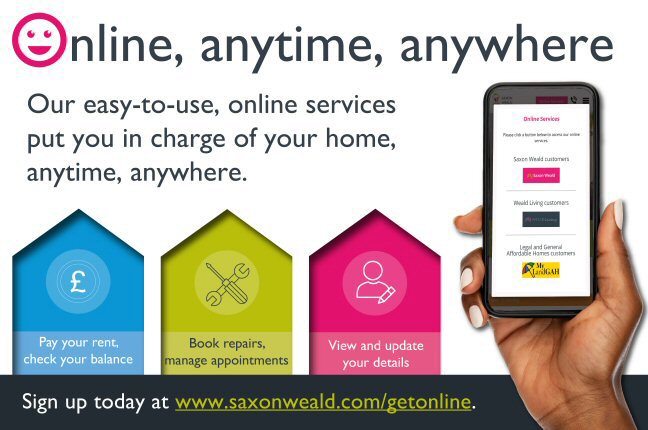

Once registered, residents can:

Our HomeFix team carried out 17,575 repairs last year.

Click here to find out more about the service.

2 April

Another chance to win a week's rent

We want to make sure our services meet our customers’ needs. To help us plan, we’d like to find out a bit more about our customers and their circumstances.

15 March

26 February

21 February

12 February